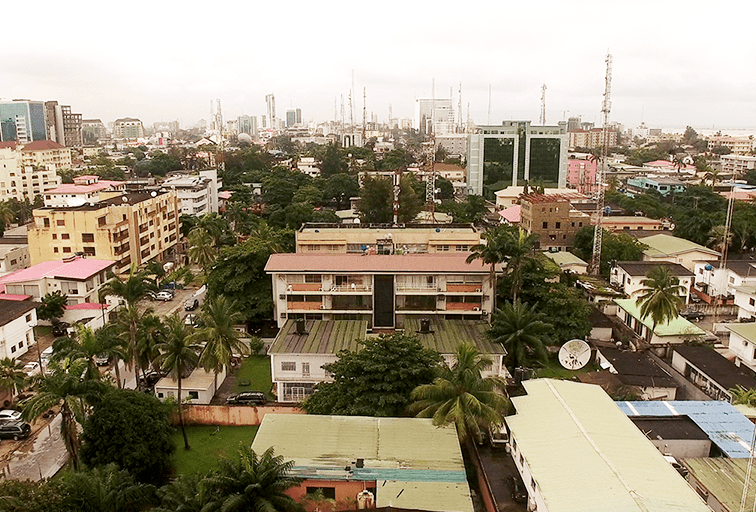

ナイジェリア連邦共和国とは?

ナイジェリア連邦共和国はイギリス連邦加盟国の⻄アフリカに位置する連邦制共和国です。 人口約1億9000万人はアフリカ最大の人口大国であり、世界でも第7位に位置しています。

またナイジェリアの人口は2050年までに4億人に増えて米国を抜き、中国、インドに次いで世界で3番目に人口が多い国なるとみられています。(2100年には8億人近くに増えるとも推測されている。)

フロンティア国としての

ナイジェリア

ナイジェリア連邦共和国は「フロンティア(未開拓)市場」と呼ばれ、新興国株への投資が先行きが不透明感を増している現在、新たな投資先として近年世界中の投資家に注目を浴びています。

急成長を期待させる潜在的な要素として、 2050年までには世界第3位の4億人と予想される人口の増加、MicroSoftやAmazon、facebookのような巨大IT企業の近年の参入、 また銀行口座を持たない人が3000万人を超える現状、その様な人々へスマホアプリ決済サービスを提供するフィンテック企業の参入など、他にも様々な成長要素はありますが、これほど好条件が揃っているのは世界的にも非常に稀です。

このタイミングで将来の伸び代が大きいナイジェリア株式投資をすることで大きなリターンが期待できると考えています。

ナイジェリア連邦共和国が

成長期待できる理由

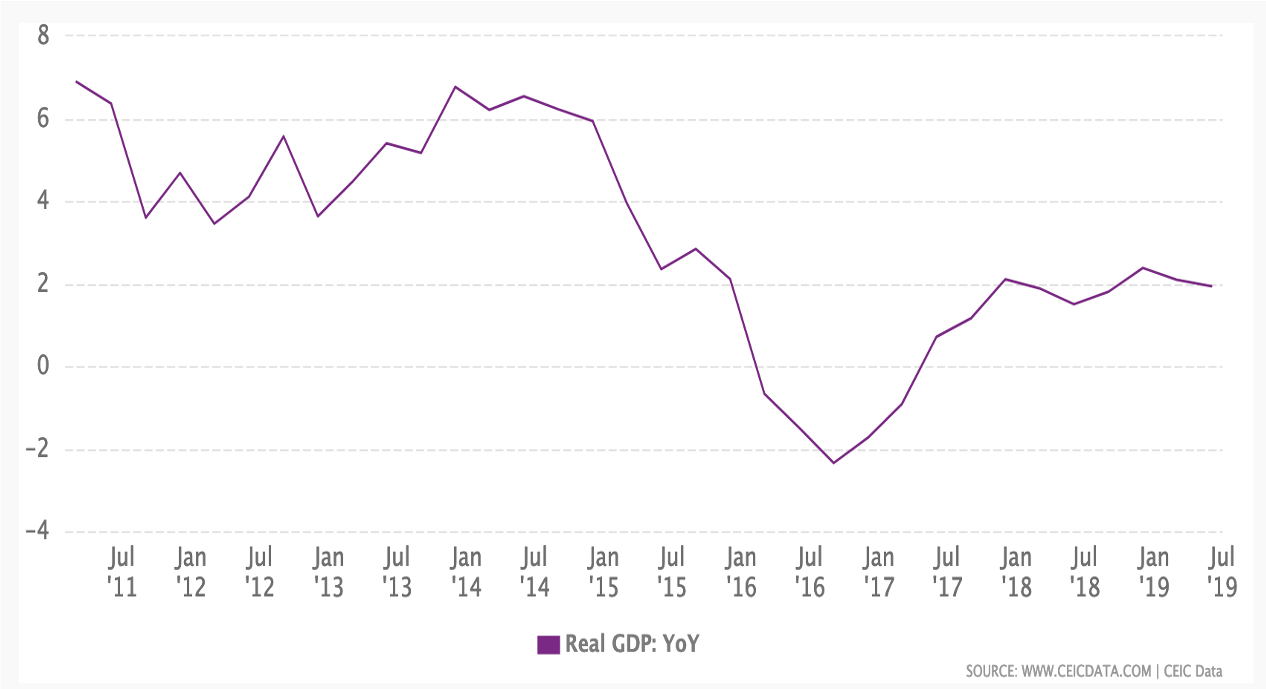

経済成⻑率

ナイジェリア市場は2016年まで低迷を続けていたものの、2016年後半から回復の兆しをみせ、2017 年には経済成⻑率はプラスへと転じる。

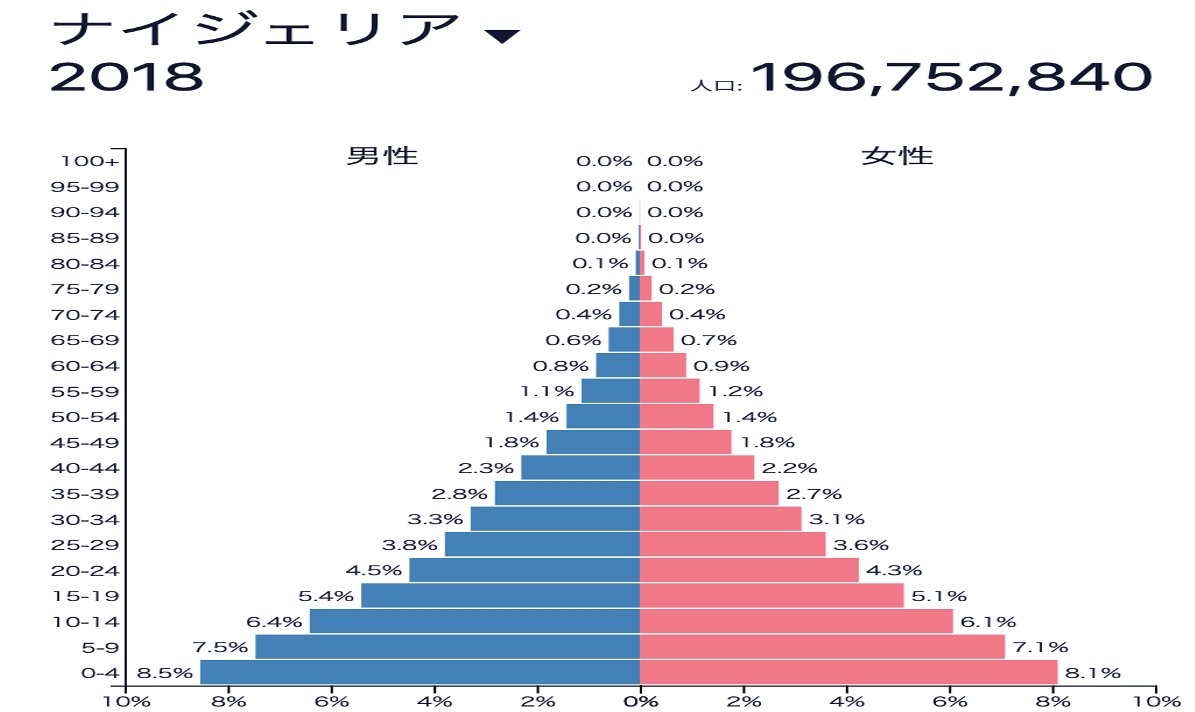

人口分布図

ナイジェリアの人口分布図では0歳から4歳の人口の層がもっとも多く、その数はなんと日本の人口の4分の1に匹敵する3270万人です。

株価指数

ナイジェリア市場の株価指数は2008年の65652を最後に、長く低迷を続けており低迷を続けているからこそ、やすく株式を取得できるチャンスだと考えています。

なぜナイジェリアの株価は

上がらないのか?

最大の原因2つと解決の可能性

政治の汚職

石油産出国でもあるナイジェリアは、国際監視機関トランスペアレンシー・インターナショナルの 調査でも最も腐敗した国ランキングの常連です。 最近の報告書によると、1960年の独立以来、国庫の使途不明金は約4000億ドル(5760億円)に上ると言われています。これが国の中で貧富の差を拡大させ経済へも悪影響あたえています。

解決の可能性

現ナイジェリア大統領のハンマド・ブハリ大統領氏(任期4年。2019年に2期目の当選)は汚職撲滅や治安対策などを「次の段階」に進めることを最重要課題としており今後4年間で大幅に改善される見込みがある。

テロ活動

ナイジェリアには「ボコ・ハラム」と呼ばれるスンニ派過激組織があり近年、治安当局のほか、一般市⺠へも攻撃対象を拡大しています。その影響もあり経済には悪影響も出ています。

解決の可能性

現ナイジェリア大統領のハンマド・ブハリ大統領氏は最重要課題として汚職撲滅や治安対策を積極的に取り組んできました。テロ組織である「ボコ・ハラム」の掃討作戦によりボコ・ハラムの活動は弱体化しており、完全撲滅を目指しています。

ナイジェリアのオススメ株

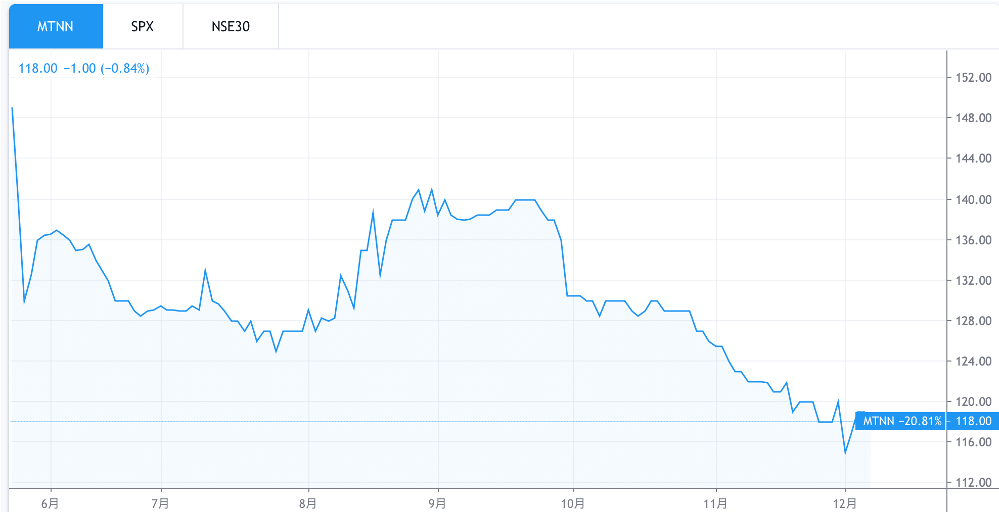

MTN NIGERIA COMMUNICATIONS PLC

ナイジェリアの証券取引所で投資ができる携帯通信事業会社の『MTN NIGERIA COMMUNICATIONS PLC』です。 MTN NIGERIA COMMUNICATIONSはナイジェリア国内で6100万人以上の契約を保有する会社。

MTN NIGERIA COMMUNICATIONS PLCは企業業績好調で配当金が高いものの、株価が低迷しているため配当利回りが8%を超える状況となっています。 株価は1株118NGNで(36円くらい)割安感があります。(2019年12月現在)

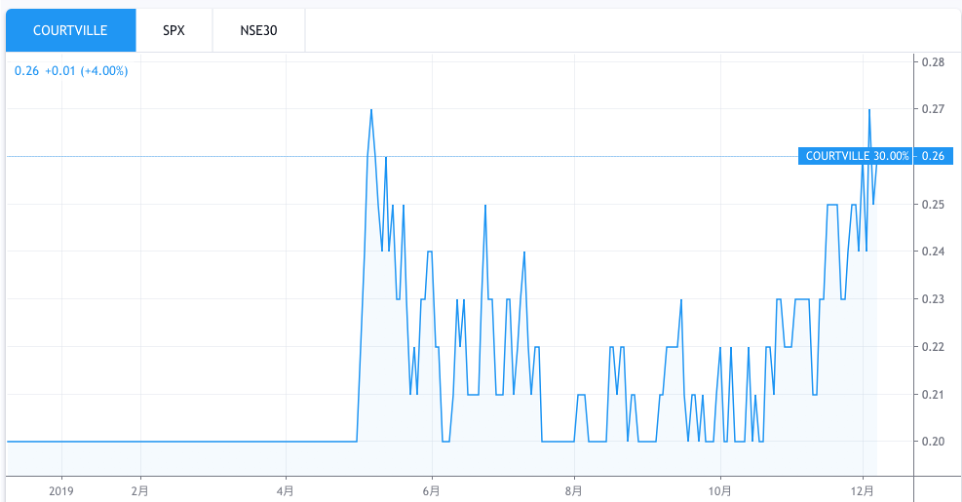

COURTEVILLE INVESTMENTS PLC

急速にスマートフォンやインターネットサービスが普及する中、ナイジェリア市場におけるトップカンパニーです。

2019年に上場したばかりの企業ですが、市場では順調に資金調達を行い、好調な企業業績から株価の成⻑が期待できます。1株0.26NGN(0.08円)

投資の流れ

ジョージア国最大の銀行で

定期預金を組む

ジョージア国の銀行の定期預金金利は

ジョージア国の通貨ラリ建ての場合

年間で10.10%の金利(2019年4月現在)を

受け取ることが可能です。

つまり、100万円をジョージア国の通貨ラリに両替し

定期預金を組むことで

年間約10万円相当のラリを受け取ることが可能になります。

受け取った金利は

ナイジェリアの証券口座に送金

ジョージア国の銀行の定期預金金利は

毎月受け取るという設定が可能なため、

その設定を行えば毎月約0.83万円の金利を

受け取ることが可能です。

そして、この毎月入る約0.83万円を

ナイジェリアの株式投資に回します。

受け取った金利で

ナイジェリアの株式に投資

100万円の自己資金はリスクのある投資には回せない。

しかし、この100万円があふれ出た金利であれば、

仮に株式投資で失敗をしたとしても

自己資金は損失を受けることはありません。

Beograd Consulting Groupの

サポート体制

Beograd Consulting Groupのサポート体制

ナイジェリア連邦共和国と投資家様の間には

Beograd Consulting Groupがサポート会社として入っており、

銀行のトラブルから株式のオーダーまで、

全てBeograd Consulting Groupが日本語でサポートします。

また、銀行が破綻した際のペイオフ申請も

Beograd Consulting Groupで代理申請が可能です。